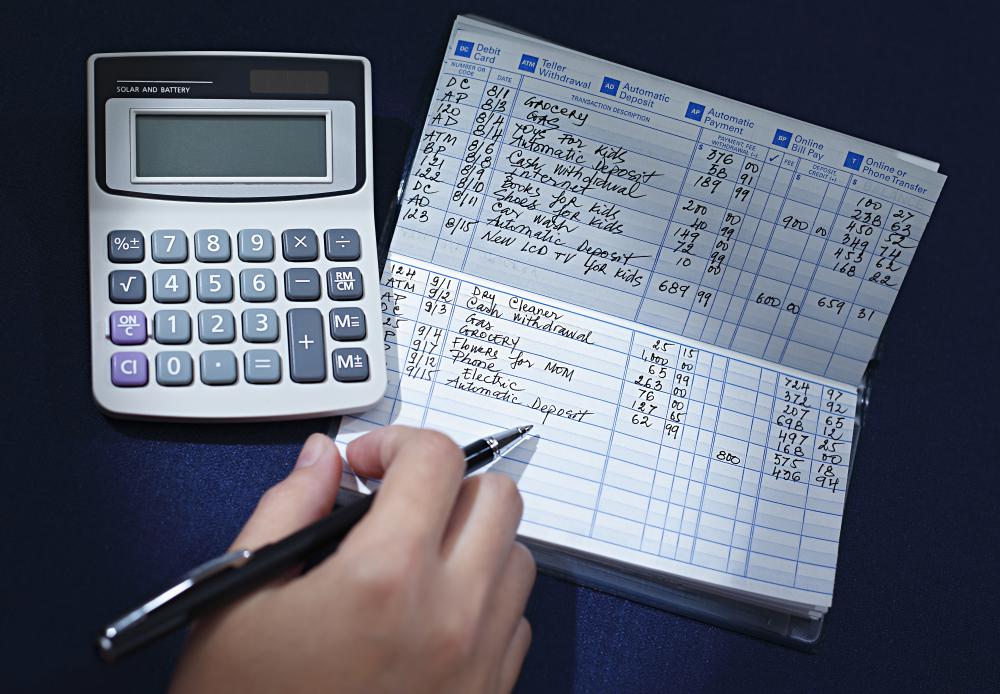

(ii) All receipts in cash are posted on the debit side with amounts in the cash column. But payments by cash are posted on the credit side with amounts in the cash column. (i) All payments by cheque decrease bank balance so these are posted on the credit side and amounts are posted in the bank column. Even a small business enterprise maintains current account with a bank through which it pays and receives.Įntries and Postings in Double Column Cash Book : A business enterprise pays through cheques and collects money from its customers through cheques. Now-a-days volume of bank transactions of even a small business are so high that Single Column Cash Book is not so useful. In this format of Cash Book, cash and bank transactions are recorded and thus it gives ledger of both the cash and bank accounts. It is not possible to spend cash without having cash in hand. (7) Single Column Cash Book will have always debit balance. (6) Amount of the transactions are posted in the ‘Amount Column’ of the debit side for cash receipts, i.e., debit postings and of the credit side for cash payments, i.e., credit postings. of the corresponding debit accounts are given in the ‘L.F. Column’ of the debit side and for credit posting ledger folio Nos. of the corresponding credit accounts are given in the ‘L.F. of the evidence of transaction is recorded of the ‘Voucher No.’ column in the debit side and for credit posting that of the credit side. For credit posting date of transaction is mentioned in the ‘Date column’ on the credit side. for cash receipts, date of transaction is mentioned in the ‘Date Column’ on the debit side. Likewise ledger postings in the Cash Book too postings are made in the ‘Particulars Columns.’ But likewise in journal entries a narration is added.

Which is posted as ‘By Telephone Deposit A/c’ Take the example of payment made for installation of Telephone Fittings on 7th Jan. Similarly, for all payments, postings are made on the credit side using prefix ‘By’ with the corresponding debit account. Which is posted on the debit side as To Capital A/c’. For example, for the transaction dated Jan. For all cash receipts postings are made on the debit side of Cash Book using prefix ‘To’. Cash payments arc also called cash outflows. For every cash payment cash account is credited since it decreases cash balance. For every cash receipt cash account is debited since it increases cash balance which is an asset. Cash receipts are also called cash inflows. (2) Cash balance is increased by cash receipts. (1) Make the transaction analysis to identify debit and credit accounts.įor a cash transaction one of the accounts must be cash account. Paid Rs.10,000 for installation of telephone.Įntries and Postings in Single Column Cash Book

0 kommentar(er)

0 kommentar(er)